ACCA转HKICPA的具体方法,你敢不看?!

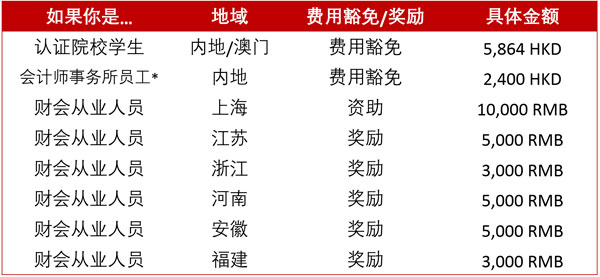

ACCA MEMBERS APPLYING FOR HKICPA MEMBERSHIP SECTION 2 - STUDENTS WHO REGISTERED WITH ACCA AFTER 15 AUGUST 20042.1 Under this ARA, who is eligible to apply for membership of HKICPA? An applicant who is a member of ACCA applying for membership of HKICPA must have:an Accounting Degree or a Non-Accounting Degree accredited or recognised by HKICPA; passed the ACCA Professional Examination in Hong Kong or the UK which must include:ACCA syllabus before December 2007 ACCA syllabus effective from December 2007 Paper 2.2 (HKG) – Corporate and Business Law (Hong Kong) F4 (HKG) – Corporate and Business Law (Hong Kong) Paper 2.3 (HKG) – Business Taxation (Hong Kong) F6 (HKG) Taxation (Hong Kong) Paper 3.1 – Audit and Assurance Services P7 – Advanced Audit and Assurance Paper 3.2 (HKG) – Advanced Taxation (Hong Kong) P6 (HKG) – Advanced Taxation (Hong Kong) Paper 3.7 – Strategic Financial Management P4 – Advanced Financial Management completed and passed the workshops of any one of the four modules of the HK QP; passed the Final Professional Examination of the HK QP; passed the HK Aptitude Tests on Hong Kong law and taxation or the ACCA Hong Kong law and taxation variant papers mentioned above; satisfied HKICPA that he has at least three-years' practical experience in accountancy which has been gained under an Authorised Employer or Authorised Supervisor complying with the HK Practical Experience Requirement; Registered as an ACCA student in Hong Kong or the UK. 更多hkicpa考试信息,请关注香港注册会计师学习网【http://www.hkicpa.cn/】,我们会在第一时间更新hkicpa考试信息。 |