hkicpa历年试题分享,你GET了吗?

|

HKICPA QP Module A考试试题分享:

Answer ALL of the following questions. Marks will be awarded for logical argumentation and appropriate presentation of the answers.

CASE

Assume that you are Mr. Peter Wong, the accounting manager of Coconut Limited (CCN). CCN is a company incorporated in Hong Kong and is primarily engaged in the manufacturing of shampoo and the manufacturing and selling of facial tissue. CCN has a long history and experience of selling its facial tissue under its own brand name.

CCN has recently formulated its strategic plan to use its own marketing platform to sell and market its shampoo products. Strategically, on 1 April 2009, CCN issued 2,000,000 of its own shares (fair value of $10 per share on 1 April 2009) and paid $6,000,000 in cash to the shareholders of Kakapo Limited (KKP), a company that owns a brand name (Yeh-yeh), to acquire 90% of the shares of KKP. KKP is not related to CCN before this business combination. CCN intends to manufacture and sell its products under the brand name of Yeh-yeh.

To induce the shareholders of KKP to accept the offer, CCN gave a guarantee where CCN agreed to pay additional cash of $1,500,000, if the 2,000,000 shares issued did not have, at 1 October 2009, a value of $8 per share. Fair value of this contingent consideration was estimated to be $400,000 at the date of acquisition.

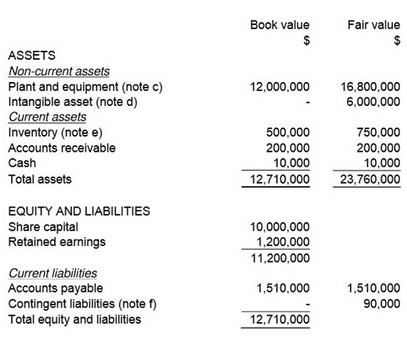

The book and fair values (before considering the impact of deferred tax) of KKP’s assets and liabilities as at 1 April 2009 are shown below:

Additional information:

(a) On 1 October 2009, the market price of the 2,000,000 shares issued by CCN was $7 per share, which is below the guaranteed value of $8 per share. Therefore, on 10 October 2009, CCN had paid $1,500,000 in cash to meet the contingency. The impact of this contingent consideration has been included in the preparation of the financial statements of CCN and KKP for the year ended 31 March 2010.

(b) Non-controlling interests were measured at their fair value of $2,200,000 as at acquisition date.

(c) The remaining useful life of plant and equipment as at 1 April 2009 was ten years.

(d) The intangible asset was a brand name, Yeh-yeh, owned by KKP. This brand name,Yeh-yeh, originally named after a famous singer in the 1960s, had been successful for many years with regard to shampoo products. The brand name is well known internationally and the technology related to the product does not change rapidly. The brand name was classified as having an indefinite useful life.

(e) 90% of the inventory, held by KKP as the date of acquisition, was sold by 31 March 2010.

(f) As at 31 March 2010, no recognition was made for contingent liabilities in the separate financial statements of KKP. However, a disclosure was made in the footnotes of KKP in relation to the contingent liabilities. Although CCN considered that it was not probable that an outflow of resources would be required, the contingent liabilities involved an obligation that had arisen from a past event and its fair value was measured reliably as $90,000 as at 1 April 2009.

(g) 10% of the goodwill on this business combination was impaired as of 31 March 2010.All the goodwill on this business combination was related and allocated to KKP’s operation and there is no impairment in other assets of KKP after performing the impairment review.

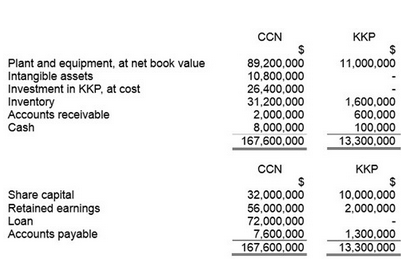

(h) Investment in KKP was carried at cost. Both companies did not have any reserves other than retained earnings.

(i) During the year ended 31 March 2010, KKP sold goods costing $3,200,000 to CCN for $4,800,000. On 31 March 2010, CCN continued to hold 40% of its purchases from KKP.

(j) Tax effects on fair value adjustments and intra-group transactions are to be recognised at a tax rate of 16%.

The draft statements of financial position of the two companies as at 31 March 2010 are shown below:

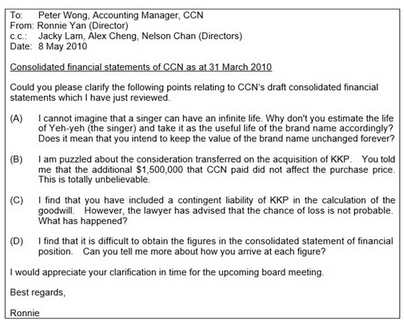

You have prepared the draft consolidated financial statements of CCN for the year ended 31 March 2010. After you sent these draft consolidated financial statements to CCN’s directors for review, one of the directors, who is not a certified public accountant, sent you an e-mail as follows:

Question 1

Assume that you are the accounting manager, and you are required to draft amemorandum to Ronnie Yan, a Director of CCN. In your memorandum, you should:

(a) briefly discuss the appropriateness to account for the brand name, Yeh-yeh, as having an indefinite useful life. Advise whether the value of the brand name will remain unchanged forever;

(b) discuss and advise the accounting treatment for the contingent consideration of $1,500,000 paid by CCN as a result of the guarantee. Illustrate your response by showing the related journal entries;

(c) briefly discuss and advise the accounting treatment for the contingent liability.Illustrate its impact by showing the calculation of goodwill; and

(d) prepare an annex to your memorandum showing the consolidated statement of financial position as at 31 March 2010, and the detailed calculations of each figure (Consolidation adjustments are to be shown in the form of a worksheet).来源:高顿,由香港注册会计师网【www.hkicpa.cn】整理发布,原创文章,若需引用或转载,请注明来源! |